Understanding Payment Processing Costs Fully

Payment processing costs play a crucial role in the financial health of businesses. When customers make payments, businesses incur fees for processing those transactions. These fees are determined by various factors, including the risk level of the transaction, the type of card used, and the pricing model of the payment processor. It is important for businesses to fully understand these costs to effectively manage their finances and maximize profitability.

Key Takeaways:

- Factors that affect payment processing costs

- Types of fees that are included in processing payments

- Minimizing payment processing costs can contribute to higher profit margins.

- Types of programs that can affect your bottomline and costs

Factors that Affect Payment Processing Fees

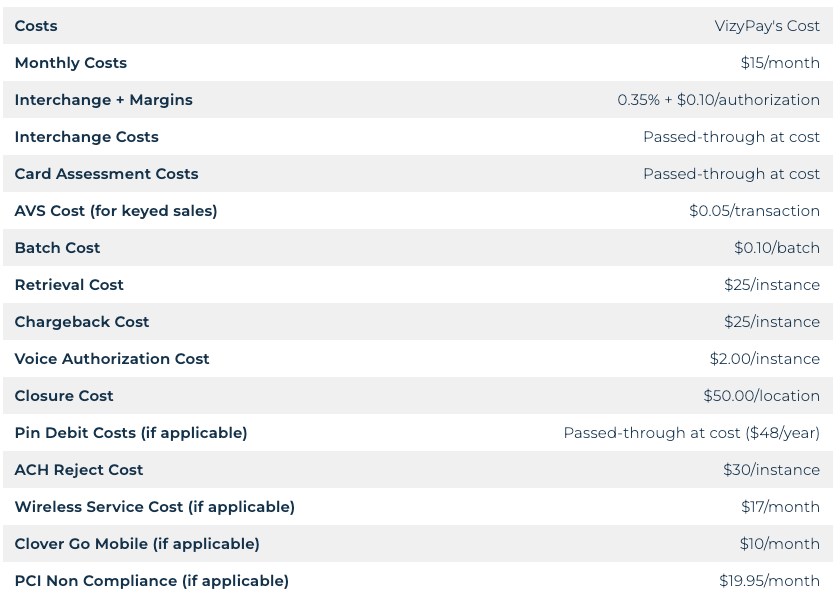

The amount of fees that merchants pay for accepting credit card payments depends on various factors. These factors include the interchange rate, merchant account provider fee, and the card processing method.

Interchange Rate

The interchange rate is a fee charged by credit card issuers for each transaction. It can vary based on the type of card, risk level of the merchant, and the payment method used. Different card networks, such as Visa, Mastercard, and American Express, have their own interchange rates. Additionally, the risk level of the merchant, which is determined by factors such as credit history and industry type, can also impact the interchange rate.

Merchant Account Provider Fee

Merchant account providers charge fees for processing credit card payments. These fees can include transaction fees, monthly maintenance fees, and dispute fees. Transaction fees are charged for each processed transaction and can be a fixed amount or a percentage of the transaction value. Monthly maintenance fees are recurring charges for maintaining the merchant account, while dispute fees are incurred when there is a dispute or chargeback on a transaction. Your merchant account provider fees are typically determined by the program you signed up for.

At VizyPay our different programs range in fees and costs depending on what our small business owners want to accomplish. Our most popular one is our Cash Discount Program that can cut out 100% of your payment processing fees. The only fee you'll have to worry about is our program fee, which can cost as low as $25 a month to process card payments.

Card Processing Method

The method by which a card is processed also affects payment processing fees. Different card processing methods include in-store swiping, online transactions, or over-the-phone transactions. Each method may have its own associated fees, such as hardware fees for in-store swiping or additional security measures for online transactions.

By understanding these factors that affect payment processing fees, merchants can make informed decisions when choosing their payment processing solutions. Comparing interchange rates, merchant account provider fees, and considering the card processing methods can help businesses optimize their payment processing costs.

Types of Fees Included in Payment Processing Fees

Payment processing fees can be structured in different ways to accommodate the unique needs of businesses. The three main types of fees commonly included in payment processing fees are flat fees, interchange plus pricing, and tiered fees.

Flat Fees

Flat fees are fixed rates charged for all transactions, regardless of the card type or the purchase method. This pricing model offers simplicity and transparency, as businesses pay the same fee for every transaction, making it easier to calculate costs and manage finances.

Interchange Plus Pricing

Interchange plus pricing involves charging an interchange fee, which is set by the credit card issuer, plus a fixed fee or a percentage of the transaction.

Tiered Fees

Tiered fees categorize transactions into different tiers based on the risk level. Each tier has different fees associated with it, such as qualified, mid-qualified, and non-qualified rates. Qualified rates typically apply to transactions that meet specific criteria and have the lowest fees.

Here's a table summarizing the different types of fees included in payment processing:

| Type of Fee | Description |

|---|---|

| Flat Fees | Fixed rates charged for all transactions |

| Interchange Plus Pricing | Interchange fee + fixed fee or percentage per transaction |

| Tiered Fees | Transactions categorized into different risk tiers with associated fees |

By considering the various fee structures, businesses can make informed decisions to optimize their payment processing costs and maintain their financial health. Click here to read a blog that talks more about payment processing fees.

Conclusion

Understanding payment processing fees is crucial for effectively managing costs and ensuring the financial health of your business. By having a comprehensive knowledge of the factors that affect payment processing fees and the types of fees included in the payment processing structure, businesses can make informed decisions and negotiate better rates with payment processors.

In conclusion, by gaining a thorough understanding of payment processing costs and employing strategies to minimize costs, businesses can not only save money but also enhance their business. Making informed decisions, negotiating better rates with payment processors, and optimizing payment processing methods are essential steps towards achieving long-term success for your business.

And if you're interested in getting started today then VizyPay can get you on the right track with your savings!

Get Started With VizyPay

Feel free to view our other blogs to find more content like this to make sure your small business is up to date on all industry news, content, and educational content!

%20(6).png)

.png)

.png)

-1.jpg)

.png)

.png)

.png)

-1.png?width=175&height=98&name=White%20VP%20Logo%20(1)-1.png)