How To Effectively Read Your Credit Card Processing Statement

Credit card processing statements can be confusing. There are no real standards or guidelines that regulate them. The lack of regulation allows processing companies to determine how confusing your statement is to read. This can be a tactic to hide the possibility that you're overpaying them. If you're curious about your statement, read this guide to examine if there is anywhere you could be saving!

What is a merchant statement?

A document that itemizes your business's sales activities and transactions for the month. This contains the total amount of transactions as well as the fees that were charged to your account. It will list the types of payments used in each transaction and the interchange costs incurred for each transaction.

How to effectively read yours.

Step one: Calculate your effective rate

When you signed up with your current credit card processor, they may have given you a low rate or a range of rates for processing cards at your business. Yes, these figures can estimate how much you're paying, but the most accurate way to determine your fees is to run the actual numbers in your business.

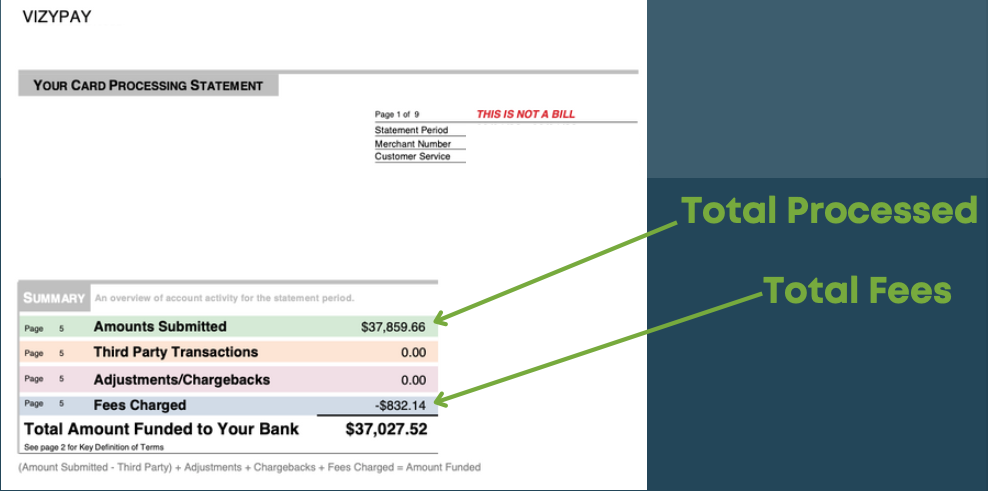

Finding your effective rate

To do this, divide the total dollar amount that you processed by the total fees charged by your processor. Effective rate = Total Fees Charged / Total Amount Processed x 100

Step two: Determine interchange costs

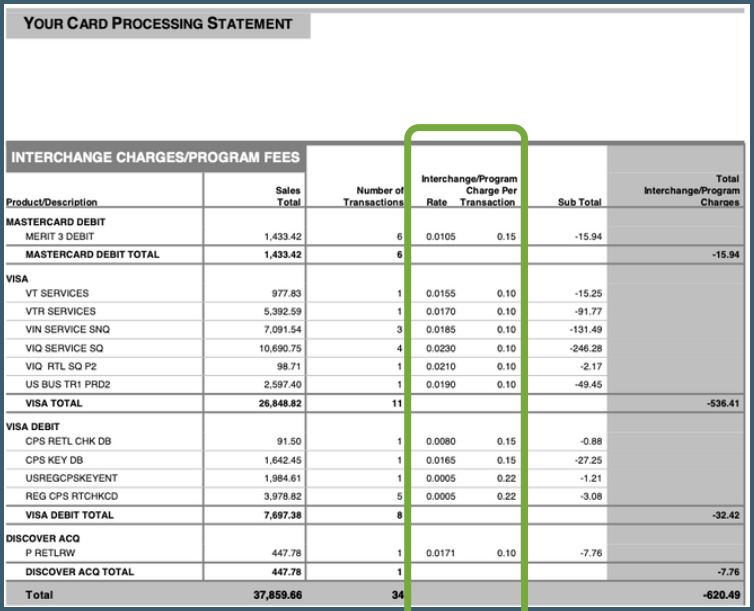

Interchange is the cost associated with debit/credit cards that are ran at the time of sale. Your interchange costs are the fees that card issuers (VISA, Mastercard) charge. Payment Processing companies do not control these rates, and every merchant is required to pay interchange.

In your statement, find the section that details your interchange costs. (fees charged by MC/Visa/Amex/Disc)

Step Three: Deduct Total Interchange Fees From The Total Fees Charged

You've already determined the fees that you're paying the card issuers. In this next step, we will find out the fees that are going to your processor.

Remember the total fees you identified in step 1? Use that number and then subtract your interchange fees from the total.

Total Fees Charged - Total Interchange Charges = Processor's Fees From our example above this equation would be 832.14 - 620.49 = 211.65

Now you have calculated the cost that you're paying your current processor. At this time, you can evaluate if this is a reasonable expense for your business. This process can be overwhelming, and your processor may not always be honest with you, but thankfully there are other options.

Cash Discount 2.0

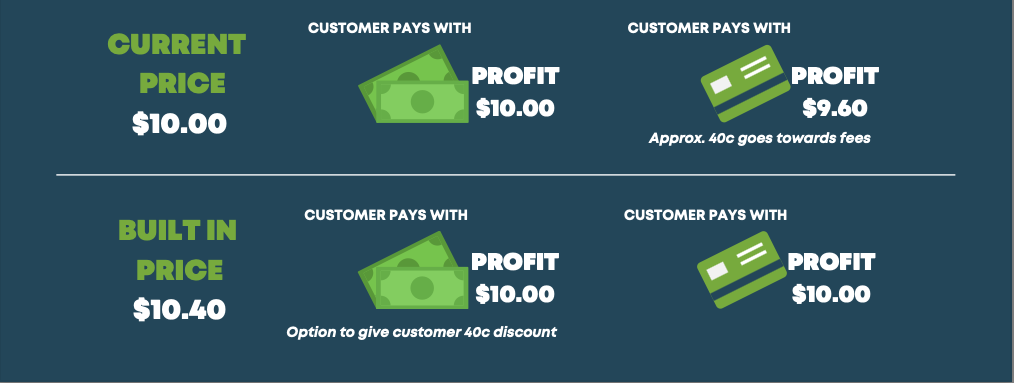

This program allows the business owner to take control of their processing costs and even eliminate the fees altogether.

How does it work? Your processing company will help you build the cost-to-process cards into your pricing, which allows you the same profit margin on every sale regardless of the payment type. When a customer pays with a card, specific technology can automatically isolate the processing fee included in the price and apply it to your processing cost.

Business owners should have the option to eliminate credit card processing fees completely. This is why VizyPay is focused on Cash Discount 2.0; we believe you should have options. Our programs are all subscription-based, and you can pay as low as $25/month to implement this program that offsets all of your fees.

-1.png?width=175&height=98&name=White%20VP%20Logo%20(1)-1.png)